FII outflows countered rising exports

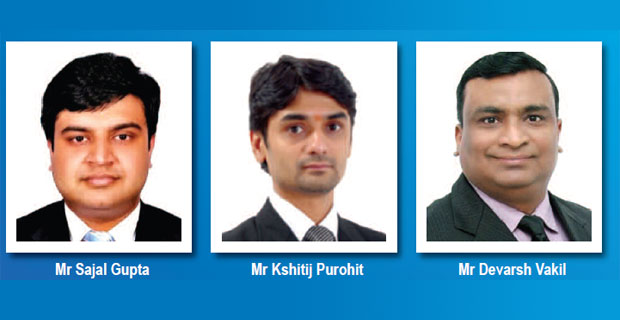

MUMBAI: Heavy FII fund outflows from the equities segment countered rising exports to dent the Indian rupee in 2021. Besides, high crude oil prices along with US Fed’s tapering measures added to the woes of the Indian currency. However, RBI’s suspected intervention and IPO inflows balanced the scale for rupee. Accordingly, the rupee weakened by 1.78 per cent to 74.34 to a US dollar from 73.06 on December 31, 2020. “In 2021 USD-INR remained volatile and made an ascending triangle and upward moving channel. The range broke in November and made a high of 76.41,” said Sajal Gupta, Head, Forex and Rates, at Edelweiss Securities. “However, towards the year-end, it plunged sharply by almost Rs 2 to 74.09,” he added.

The rupee appreciated the most in May by 2 per cent and depreciated the most in June by 2.55 per cent. “The largest ongoing FPI outflows of around $12 billion severely harmed the rupee after November. In the beginning of 2021, FPIs kept investing in the market, but once the US Fed announced tapering measures, FPIs kept selling and booking profits,” said Kshitij Purohit, Lead Commodities and Currencies, CapitalVia Global Research.

“However, due to India’s substantial foreign exchange reserves and greater foreign direct investment inflows, among other factors, the Indian rupee was among the most stable currencies in Asia-Pacific in 2021,” Mr Purohit added.

However, IPO-bound funds worth over Rs 80,311 crore as well as healthy exports per month supported the Indian currency. “Rupee registered a fourth consecutive year of depreciation against the US dollar. Global central banks started wounding down the ultra-loose monetary policies amid surging commodity prices that stroked fears of higher inflation,” said Devarsh Vakil, Deputy Head of Retail Research, HDFC Securities.

Comments.