|

INAUGURAL SESSION

The Inaugural Panel: L to R: Dr. A. Didar Singh, Dr. E. M. S. Natchiappan, Mr. Sidharth Birla and Mr. Inder Singh

The inaugural session panel consisted of Dr. E. M. S. Natchiappan, Minister of State for Commerce & Industry; Mr. Sidharth Birla, President, FICCI; Mr. Inder Singh, Chairman, GOPIO; and Dr. A. Didar Singh, Secretary General, FICCI, who opened proceedings with his remarks on GIBC and with his invitation to Mr. Birla to make the welcome address.

Mr. Birla said that though the economy has been going through trying times and though there was an urgent need to get back to the 8% to 9% growth levels, positive sentiments have already started surfacing. Mr. Birla attributed this to efforts and policy initiatives taken by the government and the Reserve Bank of India. India, he mentioned, has historically been fair to business and has also been a profitable destination. The combination of democracy and demography gives India an edge over other countries. India has liberalized product markets and is now seriously looking the factors of production in order to generate real competition.

He said it is important to rebuild mutual trust between the government and business houses, and infuse a positive environment for business expansion. Mr. Birla added that positive intentions of the government often get overshadowed by noise over substance and that was easy for the atmosphere to get sidetracked by media and civil society, and by activism. FICCI, he said, feels the urgent need for government, business and civil society to rebuild mutual trust. In this direction, he stressed upon good governance, which also includes clear and predictable policies, tax equity and effective implementation.

Mr. Birla also spoke about FICCI’s Economic Agenda, which centers on job creation, enabling growth of enterprises, growth in manufacturing and development of world-class infrastructure.

Mr. Birla’s address was followed by a special address by Mr. Inder Singh. He spoke on the formation of the Global Organisation of Persons of Indian Origin (GOPIO) 25 years ago as a network for the global Indian community. Mr. Singh informed that there are 28 million people of Indian origin living abroad and, of these, 11 million still have an Indian passport. He said that the diaspora purchases Indian merchandize and services worth billions of dollars and provides a huge pool of remittances, estimated at $72 billion in 2013. Mr. Singh suggested that the Government of India should revisit some of the policies in order to make investments and trade simpler.

Mr Sayantan Chakravarty of the India Empire Group introduces the panel for the Inaugural Session. Sitting from left are Dr A Didar Singh, Secretary General,

FICCI, Dr E.M.S. Natchiappan, Minister of State for Commerce and Industry, Mr Sidharth K.

Birla, President, FICCI and Chairman, Xpro India Ltd. and Mr Inder Singh, Chairman, GOPIO International

The inaugural address was given by Dr. Natchiappan, who thanked people of Indian origin for having affinity for India. He said that Brand India created by Indian expatriate achievers would also be reflected in the quality of goods and services produced in India. “I specifically want to say that India is a very stable country though you would feel it otherwise looking at the headlines the newspaper and channels. Please do not believe the starved and appetite oriented media in India. India’s constitution is very strong and you should believe in it. All three pillars of the constitution are working very peacefully and properly,” Dr. Natchiappan said.

The minister stressed that there are huge investment opportunities opening up in India, including the Indian diaspora, in the National Investment and Manufacturing Zones (NIMZs) that are being created all across the country. The NIMZs are envisaged as integrated industrial townships with state-of-the-art infrastructure; land use on the basis of zoning; clean and energy efficient technology; necessary social infrastructure; and, skill development facilities.

Further, industrial corridors are being created to develop a sound industrial base, served by world-class competitive infrastructure as a prerequisite for attracting investments into export-oriented industries and manufacturing. He said that new opportunities would open up with the roll out of the Food Security Act. The scheme for providing subsidized food will rejuvenate the agricultural and food processing sectors, and will provide immense opportunities for investment, he pointed out.

INFRASTRUCTURE FINANCING

The Infrastructure Finance Panel: L to R: Mr. Shailesh

Pathak, Dr. Arbind Prasad, Mr. Dilip Ratha, Ms. Pratibha

Jain, Mr. Vineet Agarwal and Dr. E. Sankara Rao

The inaugural session was followed by the session on infrastructure finance, which comprised Mr. Shailesh Pathak, President, Srei Infrastructure Finance Ltd.; Mr. Dilip Ratha, CEO, Global Knowledge Partnership on Migration and Development, World Bank; Mr. Vineet Agarwal, National Head-Financial Advisory Services, L&T Infrastructure Finance Ltd.; Dr. E. Sankara Rao, CEO, IIFCL Asset Management Company Ltd; and Ms. Pratibha Jain, Partner & Head, Nishith Desai Associates. The session commenced with a special address by Mr. Ratha and was moderated by Ms. Jain.

Mr. Ratha said that the government is considering introduction of ‘diaspora bonds’ to facilitate greater inflow of funds in the infrastructure sector in a bid to attract investment from non-resident Indians. He said that such bonds can be adopted for financing education, healthcare, infrastructure, etc, and added that $20 billion to $30 billion can be raised in one year through diaspora bonds The increasing engagement of the diaspora with the home country can be seen in the strong surge in remittances, the return of many to live and work in India, and in their increasing participation in India’s development, Mr. Ratha observed, adding that at $70 billion remittances, in fact, account for more than India’s IT exports. He also spoke about future flow securitization for mitigating sovereign risks and on performanceindexed bonds for counter-cyclical borrowing.

Mr. Pathak dwelt on the importance for the private sector to invest in city infrastructure and in offering civic facilities and on the importance of the government in creating infrastructure using municipal money in giving out existing services to the private sector. On pension funds financing infrastructure projects, he said Indian pension funds should be investing in the primary financing of Infrastructure and foreign pension funds should invest in the secondary financing of infrastructure as there is guaranteed return with the latter. Mr. Pathak dwelt on the importance for the private sector to invest in city infrastructure and in offering civic facilities and on the importance of the government in creating infrastructure using municipal money in giving out existing services to the private sector. On pension funds financing infrastructure projects, he said Indian pension funds should be investing in the primary financing of Infrastructure and foreign pension funds should invest in the secondary financing of infrastructure as there is guaranteed return with the latter.

Mr. Agarwal said several benefits have accrued with the introduction of the public-private partnership model in infrastructure financing as it has helped in better competitive commercials and also in better management resources. Mr. Agarwal added that such a model is more efficient and involves better utilisation of monetary resources.

Dr. Rao said take-out financing is a method of providing finance for longer duration projects of about 15 years by banks sanctioning medium-term loans for five to seven years.

Infrastructure projects in developing countries such as India are perceived as highly vulnerable to risks and that perception puts a constraint on financing. Some of the notable risks that need to be reckoned with are the risks arising during the period of construction leading to time and cost over-runs, operational risks, market risks, interest rate risks, foreign exchange risks, payment risks, regulatory risks and political risks. Good investment option in SEZ’s, airports, power, value added services Ms. Jain, while moderating the session, informed that India has a need for $1 trillion in the infrastructure sector and highlighted the absence of a vibrant market. She said that globally pension funds account for 40% of the infrastructure financing market, but in India it is as low as 6%.

URBAN INFRASTRUCTURE

The Urban Infrastructure Panel: L to R: Dr. Arbind

Prasad, Mr. Navin M. Raheja, Mr. Amitabh Kant, Dr. Sudhir Krishna, Mr. Rajeev Talwar and Mr. Gaurav Karnik

The second session on urban infrastructure comprised a high-level panel of Dr. Sudhir Krishna, Secretary, Ministry of Urban Development; Mr. Amitabh Kant, CEO, Delhi-Mumbai Industrial Corridor Development Corporation Ltd.; Mr. Rajeev Talwar, Group Executive Director, DLF Ltd.; Mr. Navin M. Raheja, CMD, Raheja Developers Ltd; and Mr. Gaurav Karnik, Partner-IIC, EY India, who also moderated the session.

Delivering the special address, Dr. Krishna said that as per the mid-term appraisal during the 11th Five-Year Plan, the urban share in GDP was between 62% and 63% (2009–2010) and this is expected to reach between 70% and 75% in 2030. Urban infrastructure, he said, covered a gamut of services such as drinking water, sanitation, sewerage systems, electricity and gas distribution, urban transport, primary health services and environmental regulation.

He said that the government is also deliberating on ways and means to incentivize more investment funds into infrastructure. Regulatory kinks are being smoothened, financial sector issues are being sorted out and institutional mechanisms are being tweaked to nudge private sector to invest more in infrastructure. Dr. Krishna said that new financial instruments are being devised to finance investments in the urban infrastructure space.

Serious efforts need to be made for unlocking land values to finance urban infrastructure as is being done by many countries. He said as long as the spatial distribution of project benefits can be internalized within a well-defined ‘benefit zone’, it is economically efficient to finance infrastructure projects by tapping the increments in land values resulting from them. Though land-based financing is not a practical or a desirable way to pay for the entire budget, he said that the mechanism has significant advantages if it is part of the mix of capital financing. Dr. Krishna added that public-private collaboration lies at the heart of land-based infrastructure finance.

He informed that the Ministry of Urban Development has moved beyond the mere provision of infrastructure for meeting service-level benchmarks (SLBs), which have been set for water supply, sewerage, sanitation and urban transport. It indicates a change in mindset from mere provision of infrastructure to the higher realm of meeting service delivery benchmarks. The investment requirements have been worked out for the urban sector after incorporating SLBs. Jawaharlal Nehru National Urban Renewal Mission–I (JNNURM-I) has been extended up to March 2014 from March 2012 to allow for the completion of its already-sanctioned projects.

Moreover, fresh projects can now be sanctioned until March 2014 under the transition phase of JNNURM, Dr. Krishna added.

Mr. Kant pointed out that around the globe, cities account for about 3% of the earth’s landmass, but they are responsible for consumption of 75% of the earth’s resources and for two-thirds of the world’s green house emissions. Speaking about the challenges that India faces going ahead, he said that the prime one was that cities had to be built on the back of public transportation systems to make them sustainable. Innovation and sustainable growth strategies are required besides a sustainable public transport system. While the government can create the backbone for infrastructure development, it is the private sector that must come forward and invest in these projects. The second challenge was in the use of technology in urban infrastructure in a way that India is able to come up with smart cities, intelligent cities, and in this India has a great opportunity lying ahead. Cities, he said, are the key drivers of growth and the need is to know how to use technology to leapfrog the development of smart cities. The third challenge was to deal with and mitigate issues raised by unplanned urbanization as can be witnessed in cities such as Delhi and Mumbai.

He said that the Delhi-Mumbai Industrial Corridor (DMIC) will create jobs and usher in the process of cluster developments. He said that containerized train systems will deliver goods produced in the northern parts of India to ports on the western coast of India in 14 hours, from the present time frame of 14 days. He said that in DMIC, the process of geographical planning has been converged with technological planning. The government has also planned out the Chennai-Bengaluru corridor, the Kolkata-Ludhiana corridor and the Bengaluru-Mumbai corridor.

Mr. Talwar said that there is a huge opportunity for Indian industry in urban infrastructure, mainly because the government is keen to play the role of facilitator in developing it. Largescale participation by the private sector is required for sustainable development and planning out of new cities. Integrated public transportation, processing and recycling of water and waste, and use of renewable energy are needed to develop smart cities catering to the needs of the population, he added. He also said that any company that invests in railways can become the largest power company in India and it can, by extension of its services, become also the largest telecom company in India.

Mr. Raheja emphasized that besides developing urban infrastructure, it is necessary to develop regional infrastructure as well for inclusive and sustainable growth. He said that the youth today is looking for gainful employment. Though migration from rural to urban areas has been unprecedented and will rise in the years to come, still it is essential to focus on regional infrastructure as urbanization alone cannot fulfill the increasing demands of employment and facilities required by a burgeoning population.

TOURISM & HOSPITALITY

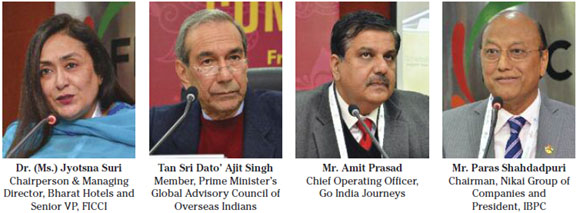

The Tourism and Hospitality Panel

L to R: Dr. Jyotsna Suri, Tan Sri Dato’ Ajit Singh, Mr. Paras Shahdadpuri and Mr. Amit Prasad

The tourism and hospitality panel comprised Dr. Jyotsna Suri, Senior Vice President, FICCI and Chairperson & Managing Director, Bharat Hotels; Tan Sri Dato’ Ajit Singh, Member, Prime Minister’s Global Advisory Council of Overseas Indians and Member, Malaysia-India CEOs Forum; Mr. Amit Prasad, Chief Operating Officer, Go India Journeys; and Mr. Paras Shahdadpuri, President, Indian Business & Professional Council and Chairman, Nikai Group of Companies. The session was moderated by Tan Sri Dato’ Ajit Singh.

Delivering the special address, Dr. Suri said that India with its mountains, beaches, adventure spots and heritage monuments has a tremendous scope and a high potential to grow. The tourism and hospitality sector has been declared a high-priority sector for the economy. The Government of India has allowed 100% FDI in all construction and development projects in the tourism sector, such as hotels and resorts. Several initiatives by the Indian government such as tax holidays and a dedicated hospitality board are in place. Major international hotel chains have a presence in India which is a promising sign. She quoted the World Travel and Tourism Council which has said that by the year 2019, India’s tourism sector is set to become the second-largest in the world and will be providing jobs to 4 million people, either directly or indirectly.

Tan Sri Dato’ Ajit Singh said that tourism has the potential to be a $1 trillion industry. He said that India received 7 million tourists last year and, in comparison, Malaysia received 25 million. Clearly, India has a huge potential to grow further. Tourism is an industry which nobody can afford to really ignore, the Tan Sri maintained.

Mr. Shahdadpuri said that the most important –ism according to him is ‘tourism’. It can give employment for every single dollar spent. In the tourism and hospitality sector, for every million spend, 78 people can be employed. India attracts only 7 million tourists in a year, which is low considering that India is a country with four seasons at any given point of time. He said India can harness this amazing endowment by taking various steps such as:

Generating increased hotel occupancy

Should create a tourism promotion organization, which can be handled by a private operator

By providing security to tourists on a priority basis

Mr. Prasad said that the tourism business is showing a lot of positive trends. There are big investment opportunities in India in this sector, he said, adding that the country is experiencing a change in segments in terms of tourists visiting. Traditionally, tourists came to India to visit temples, monuments and soak in India’s history, but now it has changed as tourists want cultural experiences and want to understand India and its society. He said India now have enough tourism options in sub-sectors such as cruise tourism, wildlife tourism, rural tourism, adventure tourism, etc. India provides huge opportunities for people to make investment such as B&B facilities, cultural parks, and rural villages. Mr. Prasad added that domestic tourism is also increasing in India at a rapid rate.

HEALTHCARE & MEDICAL VALUE TRAVEL

The Healthcare and Medical Value Travel Panel:

L to R: Dr. Arbind Prasad, Mr. C. K. Mishra, Dr. Jayesh Shah, Dr. Narottam Puri and Dr. Nandini Tandon

The healthcare and medical value travel session saw participation from Dr. Jayesh Shah, President, American Association of Physicians of Indian Origin (AAPI); Mr. C. K. Mishra, Additional Secretary, Ministry of Health & Family Welfare; Dr. Narottam Puri, Advisor-Medical, Fortis Healthcare Ltd.; Dr. Nandini Tandon, Vice Chairperson of the Board and Trustee, El Camino Hospital; and Mr. Abhay Soi, CMD, Halcyon Finance and Capital Pvt. Ltd. The session was moderated by Dr. Narottam Puri.

In his special address, Dr. Shah said that AAPI started 32 years ago in the United States after a few doctors came together to fight discrimination. Since then, it has become the largest ethnic organization representing over 100,000 physicians of Indian origin. Today, one in every seventh patient is seen by an Indian physician in the United States. Globally, about 25% of all doctors are Indian.

India, he said, has all the ingredients of becoming a medical tourist hub. “As we develop the medical tourism industry, India should be able to brand its Indian-ness,” he said. Accessible, affordable and quality healthcare solutions are going to come from innovations developed in India with the help of the Indian diaspora all over the globe. India has 18 hospitals that have JCAHO-accredited facilities and added that around 400 Indian physicians have returned to India in the last one year to provide the necessary healthcare standards in India.

Dr. Puri said that the majority of medical tourists to India come from SAARC countries, some from African and Middle East nations, and a smaller percentage from the rest of the world. Most of these patients come for procedures such as cardio, neuro, cancer, transplants, cosmetic surgeries, dental work, eye care, knee replacements and IVF surrogacy. According to Dr. Puri, the reasons for the success of medical tourism in India are as follows:

Low cost

Availability of latest technology

English speaking personnel

Increasing compliance with international quality standards and accreditation

Availability of translators

Little or no waiting

Visa-on-arrival scheme

Availability of medical visa

AYUSH, which is Ayurveda, Yoga, Unani, Siddha, Sowa Rigpa and Homoeopathy

Providing the government perspective, Mr. Mishra said that even though the recent activities in India and around the globe have seen lots of private investment coming into some subsectors of healthcare, the primarily responsibility for healthcare in India still lies with the government. One of the major reasons for the success of the private sector in medical tourism is the government’s role as policy enunciator that has been able to create a system which is able to sustain such tourism.

Speaking on the provision of healthcare service, Mr. Mishra said the government is not merely lowering the cost of medical treatment for the poor and far-flung people, not merely reducing out-of-pocket expenses, but is also providing free services, whether for treatment, diagnostics or drugs. One of the reasons for the government to do so is that while investments have come in to the tertiary healthcare sector, there has been no investment in the primary healthcare systems in the remote areas of the country. The PPP model is not yet robust in the health sector and there has not been much success until now. The primary goal in this sector is universal health coverage, he said, adding that there are four issues that must be looked at closely in this sector:

Access

Affordability

Sustainability

Quality

Dr. Tandon said that there is a huge opportunity in the healthcare sector wherein India and the USA can come together and look at areas where both countries can combine their strengths and diminish their weaknesses.

EDUCATION

The Education Panel

L to R: Dr. Arbind Prasad, Mr. Inder Mohan Singh, Mr. Prabhat Jain, Dr. Renu Khator, Prof. C. Raj Kumar and Mr. Aditya Berlia

The final session of GIBC 2014 was on the education sector. The panelists included Dr. Renu Khator, Member, Prime Minister’s Global Advisory Council of Overseas Indians and President, University of Houston; Prof. C. Raj Kumar, Professor & Vice Chancellor, O. P. Jindal Global University; Mr. Prabhat Jain, Founder & CEO, Pathways World School; Mr. Aditya Berlia, Member Board of Management, Apeejay Stya & Svrán Group and Pro-Chancellor, Apeejay Stya University; and, Mr. Inder Mohan Singh, Partner, Amarchand Mangaldas. The special address was delivered by Dr. Renu Khator and the session was moderated by Mr. Prabhat Jain.

In her address, Dr. Khator suggested that higher education should be seen as a pyramid with a strong base. She said that global partnerships are very much required to improve quality education in the country. This would entail providing access to overseas students in Indian colleges and universities, and allowing overseas educational institutions to set up campuses in India. At the same time, there is a need for direct investment in education by the diaspora as it has the talent, skills and sentimental attachment to India. Also, a culture of philanthropy must be allowed to flourish in the country to aid education in far-flung and remote areas.

Dr. Khator outlined three recommendations of the PMGAC-OI that includes a need for a culture of research and innovation. She emphasized that thought should be given to using cutting-edge technology to engage the Indian diaspora in non-traditional ways, such as facilitating addresses by international faculty through video chat and other technological platforms. Even though the education revolution is already on India’s doorsteps, the technology that needs to back it up is disrupted and not often in place. She reiterated that the focus in India ought to be on accumulating world-class talent and providing access to quality education. Quality, she said, is important at every level.

Mr. Jain mentioned that India’s education sector is on a fast growth track given that 50% of the population in India is below 25 years of age. He felt that the need of the hour is for education systems to penetrate the vast swathes of the country’s rural landscape. While this requires concerted effort from both the government and the private sector, Mr. Jain felt that at present it somehow does appear that there is a trust deficit on the part of the government when it comes to acknowledging the private sector’s growing role in this sector. He said that it is time to allay fears as several top business and medical schools are today in the private sector. Maintaining a positive note throughout his moderation of the session, Mr. Jain believed that the winds of change are truly blowing.

Mr. Berlia said that information technology alone was not going to solve the problems of the sector. Instead, it was time to introduce highly innovative business practices by utilizing a limited number of training resources. The sector should work closely with institutions such as the National Skill Development Council and allied bodies that are willing to invest. He remained skeptical about great markets emerging in the next few years in the higher education sector, emphasizing that out-of-the-box thinking and innovation would be required before investment decisions are made.

Prof. C. Raj Kumar said that the good news for India is that out of 1.2 billion people, 65% are below the age of 35, and that makes it a staggering 780 million. While the world ages, India remains young. He said while the education sector was booming, no Indian university is among the top 10 universities of the world, adding that India’s regulatory mechanisms are not progressive and that there is a need to establish more universities for higher education. One of the worrying signs, Prof. Raj Kumar said, is that young people do not want to choose teaching as a profession and, therefore, there is a paucity of trained educational personnel. There are 700 universities and 40,000 colleges in India, but there is a huge shortage of faculty. The possibility of international engagement has been reduced due to limited issuance of visas to foreign scholars who would like to come and work in India. He felt that those who were looking for immediate returns should not be investing in the sector, but also added that the focus is shifting towards international collaborations.

Mr. Inder Mohan Singh said that several initiatives are being taken in the education sector and there is no restriction in the private sector for investment for profit. The Government of India permits 100% FDI in the education sector under the automatic route. The challenges on the regulatory side are that it can only be run by a non-profit institution under the current act. FDI in the infrastructure space is permitted in the education sector on a profit basis.

VALEDICTORY

The valedictory address was given by Mr. Arun Mair, Member, Planning Commission. Mr. Maira said that while plenty of policies were in place, a trust deficit did exist between government and investors since the latter was skeptical about the implementation of those policies. The valedictory address was given by Mr. Arun Mair, Member, Planning Commission. Mr. Maira said that while plenty of policies were in place, a trust deficit did exist between government and investors since the latter was skeptical about the implementation of those policies.

He said that the Indian diaspora could partner through the India Backbone Implementation Network (IbIn) that was conceived under the 12th Five-Year Plan to bring organizational capabilities together to collaborate, coordinate and implement issues, projects and policies for the country’s development. The larger objective of the IbIn is to promote wider capabilities in the country to systematically convert confusion into coordination, contention into collaboration and intentions into implementation. This institutionalized backbone capability will provide tools and techniques to different stakeholders to ensure effective and efficient coordination, design and implementation.

Despite the many projects and implementation challenges all over the country, such an organization will comprise a lean central node catalyzing many regional or local nodes to ensure an ecosystem that is widespread in its reach and far-reaching in its applicability.

DINNER

GIBC 2014 culminated over drinks and dinner in the Connaught Room and Rooftop at the Oberoi Hotel, New Delhi. The dinner was hosted by India Overseas Consultants Ltd. The evening was attended by several senior government officials, PSU chiefs, speakers and delegates. The next edition of GIBC is tentatively scheduled for January 5, 2015. Some snapshots of the dinner session:

|